A public transit system is critical infrastructure that supports a thriving region. Just like roads, parks, libraries and emergency services, DART is a public service that is available to all of us.

A public transit system is critical infrastructure that supports a thriving region. Just like roads, parks, libraries and emergency services, DART is a public service that is available to all of us.

Every day, DART connects thousands of central Iowans to jobs, healthcare appointments, education, and other opportunities that foster a quality life. These connections help member communities attract new business, expand the workforce, and compete as a region with other cities.

View the FY 2024 DART Budget Book.

How is DART funded?

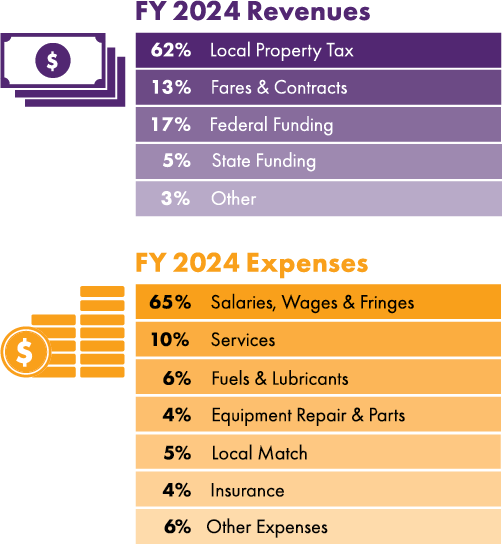

All public transit agencies across the U.S. receive public funding because they provide a public service. A mix of federal, state and local dollars allows DART to provide transit services that results in 3.2 million rides each year (more than the Des Moines International Airport!).

All public transit agencies across the U.S. receive public funding because they provide a public service. A mix of federal, state and local dollars allows DART to provide transit services that results in 3.2 million rides each year (more than the Des Moines International Airport!).

In Iowa, public transit is funded through a property tax levy, a unique funding mechanism set by the Iowa Legislature. The transit levy makes up approximately 1-2% of a property owner’s total tax bill and is significantly less than other services funded by property taxes.

Many transit agencies receive funding through other sources. The most common funding source for transit in the U.S. is sales tax. DART’s governing body, the DART Board of Commissioners, is focused on reducing DART’s reliance on property taxes by seeking assistance from the Iowa Legislature for more diverse and sustainable sources of funding for public transit.

How does the property tax levy work?

The transit levy rate in Iowa is capped at $0.95 per $1,000 of taxable valuation. The cap is based on the rate the state established 30 years ago for city-operated transit systems that had access to additional levies. Unlike other cities in Iowa operating public transit, DART does not have access to other levies, such as local appropriations, sales taxes, vehicle registration, car rental fees or other dedicated sources of funding.

DART’s other sources of revenue have restricted growth opportunities, which makes DART reliant on property taxes to absorb any losses in revenue or increases in costs.

DART’s Commission is always evaluating how to make the levy arrangement work better for member communities while supporting a regional transit system. Toward that end, the Commission adopted a new property tax formula in 2020 that reflects the level of service each community receives.

How does the new property tax formula work?

Prior to July 1, 2021, the property tax levy was increased across-the-board at the same rate for all member communities. DART’s new property tax formula aligns cost and benefit for each member community.

DART is in the third year of phasing in the new formula. Over three years, the transit levy in most DART member communities has decreased, while the largest urban areas have seen increases that match the higher service levels available in those more populated areas.

What is DART’s current budget challenge?

The cost of providing transit service has increased while the property tax levy has not increased in four of the past seven years. COVID relief dollars have filled the funding deficit, but these one-time funds are no longer available in the next fiscal year beginning July 1, 2024. In addition, the City of Des Moines' contribution to DART significantly exceeds what it can collect through property taxes. Learn more.